Journal of the NACAA

ISSN 2158-9429

Volume 9, Issue 1 - June, 2016

Beyond the Workshop: Continuing Estate and Transfer Plan Development by Providing Technological Resources

- Melendez, M. V., Agricultural Agent, Rutgers Cooperative Extension

Polanin, N., Agricultural Agent, Rutgers Cooperative Extension

Carleo, J., Agricultural Agent, Rutgers Cooperative Extension

Brumfield, R., Specialist, Rutgers Cooperative Extension

O'neill, B., Specialist, Rutgers Cooperative Extension

ABSTRACT

The Preparing for Later Life Farming program was developed to assist multi-generational New Jersey farm families with estate and transfer planning. Farm estate and transfer planning is a major undertaking for families, and it can take several years to develop a plan. We created dynamic program resources to assist participants with the development of their plan beyond the workshop. Post-workshop materials were provided on USB sticks and video recordings of the presentations are available to view online. Easy access to resources for review while making decisions reduces barriers for the continual development of farm estate and transfer plans after live trainings.

-

Introduction

Conversations with producers about farm succession often revolves around the need to develop a written plan. Producers indicate a lack of time and knowledge about how to do so and the creation of a plan often stalls. According to the 2012 U.S. Census of Agriculture, the average age of principal farm operators in the United States is 58.3 and 59.5 in New Jersey (Census of Agriculture, 2012). Farmers on average have a median net worth 7.5 times greater than U.S. households but much of the net worth is illiquid including land, buildings and equipment (Structure and Finances of U.S. Farms, 2014).

A 2012 survey of 137 New Jersey farmers who had participated in an Annie’s Project New Jersey farm business management program showed that 69% had an interest in learning more about estate planning. Almost 75% of respondents indicated that they expected to pass down the farm to their children and yet a 2011 survey showed that only 16% of respondents had a transfer plan. This 2011 survey also showed that only 40% of respondents had written down goals, and 50% had wills. New Jersey farmlands are the foundation of a strong agricultural industry, a way of life for generations of farm families, and an important part of the New Jersey economy. Providing the knowledge and tools for farm transfer is imperative for multi-generational farm families.

Methods

In-person workshops were held regionally at three Extension facilities in New Jersey. Growers have historically voiced a desire to participate in farm management and business programs, yet participation is often low. Multiple workshop locations brought learning opportunities close to participants and thus helped increase participation. Providing materials and presentation videos online allowed us to take the information beyond the classroom and into the homes of farm families unable to attend the live workshops. Traditional methods of Extension advertising were used such as connecting with other agricultural organizations in the state, county office contact lists and trade publication advertisements. Post cards were also sent to tax assessed landowners, this was an effort to reach farm owners who were not actively involved with farming or with Extension.

Constructing a team of estate plan and farm transfer experts was the foundation of this program. Rutgers Extension Specialists Dr. Barbara O’Neill and Dr. Robin Brumfield provided expertise on personal finance and business management, respectively. Both presented at the workshops, provided resources for participants, helped develop curriculum and were on hand to answer producer questions. A local lawyer with expertise in farm transfer and estate divisions spoke and offered advice to participants. University of Vermont Extension Specialist Dr. Robert Parsons was brought onto the team to provide estate plan and farm transfer expertise. His extensive knowledge of these topics was critical to the success of the workshops. Having the input of local and regional experts ensured that all relevant topics were covered and that participants’ questions were answered while in the live session.

Curriculum

A robust curriculum was an important factor in determining program presentations and resource materials. We recognized that Rutgers was not the first Extension program to develop estate and farm transfer programming; therefore the project team utilized materials created by others. The primary resource for the program was the Pennsylvania Farm Link workbook titled Planning the Future of Your Farm. Since this workbook contains references specific to Pennsylvania regulations, the Rutgers team developed a New Jersey addendum. Workbook chapters were used as reference points for each of the talks, pre-workshop self-assessments, and group work. Upon registration for the course, participants received a hard copy and emailed version of a five page self-assessment. This self-assessment, from the Planning the Future of Your Farm book, covered the following topics: rating family values, rating your comfort level, sketching your lifestyle plan and estimating income and expenses. Participants were asked to complete these assessments prior to the workshop. Assessment completion ensured that participants had at least thought about some of the realities of their farm transfer and estate plan before the workshop.

The program agenda included the following presentations:

1. Welcome and Introduction to Program Resources

2. Talking With Your Family about Transitioning Your Farm

3. Identifying Goals and Objectives (group work)

4. The Do's and Don'ts for Successful Family Estate Transfers

5. NJ Farm Estate/Transfer Examples

6. Planning the Family Meeting (group work)

7. Identifying Financial Needs for Now and the Future

8. Identifying Future Financial Needs – Personal

9. Identifying Future Financial Needs- Business

10. Identifying Income Sources

11. Financial and Legal Realities of Farm Transfer

12. Finding Your Expert Team – Financial and Legal Advisors

Communication Skills

The first barrier to developing a farm transfer plan is often family communication. The required discussions for development of this plan have the potential to inflame existing disagreements or create new ones. The program team knew that communication would be an important discussion topic and so it was first on the agenda. Who Will Get Grandpa’s Farm videos by Purdue University were used to show different types of communication, and how some forms of communication can be more productive than others. After watching each video participants were guided in a discussion about the strategies and experiences depicted.

To-Do List

A supplemental to-do list was created to help participants identify the next steps to take in their farm estate and transfer plan. This to-do list was used with the presentations and topics covered in the workshop. Space was provided on the to-do list so that they could write down tasks they identified as needing completion, and indicate an ideal timeframe.

USB Thumb Drive

A USB drive pre-loaded with handouts, PowerPoint presentations and supplemental materials was given to each of the participants. The goal was to make resources as easy to access as possible. Materials included on the USB were a PDF copy of the PA Farm Link workbook, trade publications on the topic of estate planning, and Extension publications from Iowa State University, the University of Minnesota, Montana State University, and Rutgers University. New Jersey specific worksheets were created and also provided on the USB including: Choosing Your Team of Advisors, Identifying Personal Financial Needs, Identifying Retirement Income Sources, and Digital Assets Inventory.

Setting Goals

At the end of the workshop each participant was asked to set three to five goals to achieve in the next three months. These goals were written on a postcard which was collected by the team and were mailed back to each participant three months post workshop. This step served as a reminder to their desired progress, with the goal of prompting them to continue their planning.

Website

A Preparing for Later Life Farming workshop website was created where materials, PowerPoints and videos of each of the presentations are available for viewing and download. See http://laterlifefarming.rutgers.edu/workshop/. This website serves as an information resource for participants and allows the materials and presentations to reach an audience that was not able to attend the live workshops. In the three months since the website was created the presentation videos have been watched over 200 times. Participant survey results indicate that they are referring to these videos post-workshop to review information while continuing to work on their estate and transfer plans.

Results

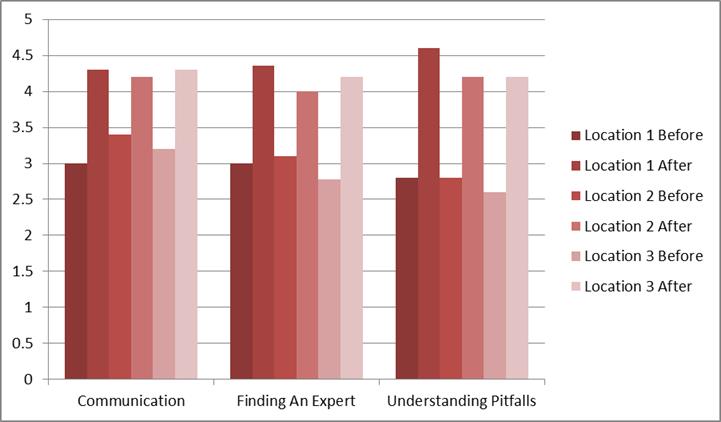

The Preparing for Later Life Farming workshops had a total of 65 participants. Eighty percent of participants responded to an evaluation distributed at the end of the workshop to assess their knowledge gain. Each question was ranked on a scale of one to five, with one being poor and five being excellent. Knowledge gain was most strong with participants ability to communicate with family members, skills to identify expert help, and understanding potential pitfalls in the estate transfer process.

Figure 1. Participant indicated knowledge gain as a result of attending the one-day workshop.

A six month post-workshop survey was conducted via SurveyMonkey online to evaluate progress made on estate transfer plans after the end of the workshop. Twenty-nine percent of workshop participants responded to the survey. Six months after the workshop respondents indicated that:

- 85% held a family meeting

- 100% located important estate documents needed

- 85% identified financial goals for the near future

- 65% identified financial goals for the far future

- 65% identified personal financial needs

- 65% identified business financial needs

- 50% evaluated their net worth

- 80% met with a lawyer and/or financial advisor

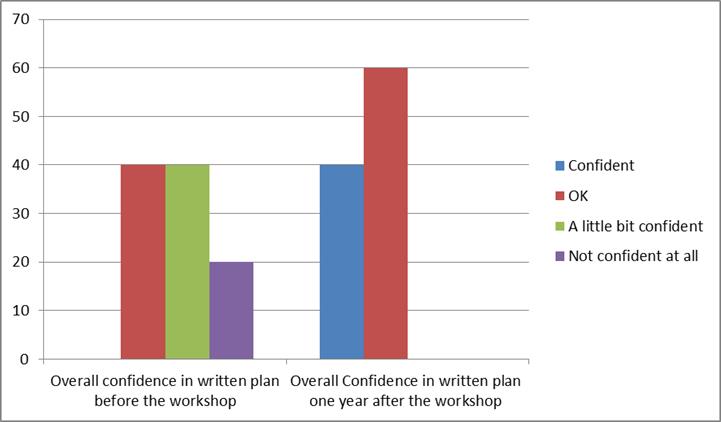

One year after the workshop a final online evaluation was given to assess participant confidence in their estate and transfer plan development, usefulness of materials provided, and general feedback. Seventeen percent of participants responded to this one year post-workshop survey.

- 100% of responding participants indicated that they found the paper handouts useful

- 80% of responding participants found the USB device materials useful

- 60% of responding participants watched at least one of the presentations online

- 40% had watched more than one presentation online.

Figure 2. Comparison of participant confidence with their written estate and transfer plan before the workshop and one year after the workshop.

Discussion

New Jersey producers indicated a need for estate and farm transfer education during previous Extension programs. Curriculum was developed to provide an understanding of the decisions to be made during the estate and transfer plan development process. Technology based materials were created with the idea of helping participants continue on their plans after the live workshop.

The pre-workshop assessment, based on the Pennsylvania Farm Link Planning the Future of Your Farm, was a valuable resource. The assessment allowed the participants to acknowledge each of the critical focus areas for their estate plan and to focus on these topics specific to their farm and family situation. Participants who completed the assessments indicated that they found them helpful in decision making discussions during the workshop.

Utilizing the Perdue University Who Will Get Grandpa’s Farm videos was an effective way of showing communication strategies for farm families. Participants were engaged during the videos, asked numerous questions and freely shared personal stories where communication styles did and did not work.

The live workshop had its intended impact, participants felt more prepared to; discuss farm estate and transfer planning with their family; evaluate future financial needs of the family and business; and identify experts who are able to assist them in the development and execution of their plan. Six months after the workshop respondents to the online survey indicated that they had made considerable progress on their plans. Impressively 85% had held a family meeting, often the first hurdle in developing a plan. Materials provided to the participants, hard copy and digital, proved effective to assist with the plan decision making process.

Providing a pre-loaded USB thumb drive with workshop supplemental materials was an important objective for the team. During the workshop the team reviewed the materials on the USB so that participants would understand the resource that they had, and ideally use. Respondents to the one-year post-workshop survey indicated strongly that they found the USB materials helpful, and that this is a type of resource that should be used for future Extension workshops.

The creation of the Preparing for Later Life Farming Workshop website was an effort to support workshop participants in the development of their estate and farm transfer plan, and to reach farmers who were not able to attend the workshops. Videos were viewed over 200 times the first 3 months following the workshop by both workshop participants and others. Survey respondents indicated that future extension meetings should be recorded and made available online. The use of online videos makes sense, especially for workshops education on the creation of a detailed plan.

Workshop participants continued progress on their estate and transfer plans in the one year since the live workshop shows that the curriculum and supplemental materials were effective. The one year post-workshop survey data shows that participants utilized these technological resources to progress on their plans. Easily accessible materials in multiple formats facilitate the continued progress on farm estate and transfer plans and can easily be incorporated into future Extension estate and transfer plan programming.

References

USDA-ERS. 2014. Structure and Finances of U.S. Farms: Family Farm Report. Washington, D.C.: USDA Economic Research Service.

USDA-NASS. 2012. Census of Agriculture. Washington, D.C.: USDA National Agricultural Statistics Service.

Acknowledgements

This material is based upon work supported by USDA/NIFA under award number 2012-49200-20031 and the Northeast Extension Risk Management Education program. Advertising support was provided by the New Jersey Department of Agriculture and Farm Bureau New Jersey.