Journal of the NACAA

ISSN 2158-9429

Volume 9, Issue 2 - December, 2016

Beef Retailer Perception of Consumer Purchasing Habits

- Blair, A.D., Associate Professor and Extension Meat Science Specialist, South Dakota State University

Underwood, K.R., Associate Professor, Animal Science, South Dakota State University

Zuelly, S.M.S., Assistant Professor, Animal Science, Purdue University

Anderson, J., Assistant Professor, Communication Studies, South Dakota State University

Johnson, J.E., Agriculture Instructor, Casper College

ABSTRACT

Consumers have an increasing number of choices when selecting meat at retail. Therefore, it is important to understand factors that limit the selection and purchase of beef. A series of three surveys of beef retailers evaluated the level of assistance provided, retailer perception of consumer beef purchasing priorities, and retailer perception of where consumers obtain information about beef. Results suggest that consumers make more informed choices when they have higher levels of assistance. Extension programming could build on this knowledge to create programming for consumers that bridges the gap between informal information exchange and retail service to aid purchasing decisions.

Introduction

Beef is one of the primary sources of protein for Americans. However, changes in consumer preferences, competition from pork and poultry and the availability of additional protein options at retail have greatly influenced the dynamics of the retail meat case (Bailey et al., 1995). Menzie et al. (1976) reported that 51.6 percent of consumers decided what cut of meat to purchase in the store (not ahead of time), and it is likely higher in today’s society. Therefore if consumers have questions or issues pertaining to beef in the retail store it is important to provide solutions in that setting. Often trained meat case employees can address these concerns; however many retail chains no longer employ meat cutters and this trend is rising. A full-service meat department would generally source wholesale cuts of meat such as a beef rib and then cut, trim and package retail cuts such as ribeye steaks in the store. In contrast, retailers with self-service cases purchase case-ready products that are stocked in the meat case. In this instance the retail cuts would be cut, trimmed and packaged before they arrive at the retailer. The National Meat Case Study (2010) evaluated the linear feet dedicated to meat products at retail and determined that 93% of the space was dedicated to self-service while 7% was full-service. The shift from full-service meat departments that employ a trained meat cutter to self-service cases highlights the need for novel methods of educating consumers about meat. Additionally, research indicates that the primary concerns that limit beef purchases are price, safety, convenience, nutritional value, sensory traits and reputation (CBB and NCBA, 2009). Therefore, building a positive perception towards beef and providing accurate information about beef products is critical to maintaining or expanding beef’s share of the protein market (Van Wezemael et al., 2012).

Extension fills a fundamental role in educating consumers about meat production from conception to consumption. However, to continue reaching an audience that is increasingly removed from food production Extension professionals must better understand the interaction between the consumer and the retailer, identify where informational gaps exist and provide answers to consumers’ questions at this level. Because the retail meat counter is the only point of contact for most consumers to the beef industry, it is important to understand what influences beef purchasing decisions at the retail level. Although these factors have been previously studied from the personal viewpoint of the consumer (CBB and NCBA, 2009; Yang and Woods, 2016), little work has focused on the perspective of the retailer. Therefore, the objectives of this study were to evaluate the consumer from the perspective of the retailer to determine 1) how the retailer and consumer interact, 2) how the retailer perceives consumer’s beef purchasing priorities and 3) where the retailer believes consumers obtain their information regarding beef. Analyzing retailer perceptions of consumer purchasing habits will improve our understanding of the consumer and enable Extension to provide training and support educational efforts by retailers.

Methods

In order to study the concerns that consumers present to the retailer at the point of sale, data collection was split into three phases. Each prior phase was used to determine information that would be needed to construct the next phase.

Phase One – Phone Interviews

The U.S. was split into four regions (west, mid-west, southeast, northeast) and 12 initial phone interviews were conducted per region (n =48) to establish a baseline of information. Respondents were identified as meat counter supervisors and gave verbal consent to participate in a phone interview. They were also informed about how the information they provided would be used. The Phase One survey was semi-structured and took 15-30 minutes to complete. Questions were related to the level of consumers knowledge (as perceived by the retailer) about beef selection, value determining beef traits, cooking temperatures and challenges that the retailer viewed as being most difficult for the consumer at the point of sale. Data collected in Phase One was then analyzed to determine common themes that were universally observed across all regions. These themes guided the development of an interview questionnaire used in Phase Two.

Phase Two – In-person Interviews

The interview questionnaire was used to guide 12 face-to-face interviews in three major Midwestern cities (Rapid City SD, Omaha NE, and Minneapolis MN); 36 total interviews were conducted. Respondents were required to be meat counter supervisors that regularly interacted with consumers as a daily function of their job. Responses indicated how retailers perceived consumers’ knowledge level, resources used to gain information, informational needs, common concerns or challenges, and beef selection criteria. Responses from Phase Two interviews were then analyzed to derive common themes. These themes guided the development of a survey to disseminate nationally in Phase Three.

Phase Three – Closed-Ended Survey

Based on the information gathered in Phase One and Two regarding consumer selection challenges, and understanding that different retail environments exist, a closed-ended survey was developed and disseminated more broadly to a larger number of retailers. This survey included questions about the type of retail assistance provided at the location as well as the type of retailer responding to the survey. These questions were presented as categorical response scales. Retailer perceptions were measured with statements about consumers that retailers could rate their agreement with, using Likert-type response scales. Participants also ranked, using ordinal response scales, factors that they perceived to influence consumer purchasing decisions. The retailers were also asked where they perceived consumers obtained their beef purchasing information, using multiple-selection categorical response scales.

Phase Three data collection was conducted using a third party distribution company that provided mailed and online survey services that were directed towards meat counter supervisors. Two-hundred seventy surveys were sent by mail, of which 53 were returned complete (19.6% response rate). Internet survey distribution parameters were set so the surveys were only sent to retail locations and specific instructions were included to indicate that only the meat counter supervisor was allowed to complete the survey. The response rate for this portion of the data collection is unknown as we are not able to know how many recipients were selected to receive the survey. There were 242 final surveys returned, of which 85.95% (n = 208) were usable (fully completed and accurately followed directions). Of the surveys used 25.48 % (n =53) were received by mail and the remaining 74.52 % (n =155) were collected through the on-line survey tool. Respondents were distributed among all four of the sampled regions: West (n = 50), Mid-West (n = 60), Southeast (n = 51), Northeast (n = 47).

Analysis of variance (ANOVA) was used to compare differences between groups and linear regression was used to evaluate relationships between variables. Statistical comparisons were performed using SPSS© version 23. All data collection and methods used in this study conformed to protocols for the study and inclusion of human subjects (approval reference: IRB-1205005-EXM).

Results

Level of Retailer Assistance Provided

Table 1 shows the level of retailer assistance provided at the meat case. The lowest number of respondents (3.8%) indicated their location offered 100% retailer assistance to meat customers. In these locations the meat is located behind a case and the customer would interact with the meat case personnel to select each cut. The greatest proportion of retailers surveyed offered a self-service setting for meat selection (41.3%). In these locations meat would be displayed in an open case in case-ready packaging that the customer could select without assistance. The remaining retailers (54.9%) indicated varying levels of combined service. In these locations a portion of the meat would be available as case-ready product (self-service) and a portion would be available with retailer assistance (full service).

Table 1. Percent of the Retail Meat Case Dedicated to Full-Service and Self-Service Functions

|

Level of Assistance* |

Percent of Retailers Surveyed |

|

100% Retailer Assistance |

3.8% |

|

75% Retailer Assistance/25% Self-Service |

6.7% |

|

50% Retailer Assistance/50% Self –Service |

12.6% |

|

25% Retailer Assistance/75% Self-Service |

35.6% |

|

100% Self-Service |

41.3% |

|

*Retailers were asked to select the level of assistance that most closely aligned with how meat products were displayed at their location. |

|

Across all levels of retailer assistance, respondents indicated that the greatest number of purchasing-related questions were from consumers perceived to be between the ages of 31-45 (51.9 %; n =108). To examine the effect of retailer assistance on consumer purchasing behaviors, a series of one-way ANOVAs were conducted, with retailer assistance as the independent variable. In terms of selection for marbling, in general, consumers had negative (70.5%) or neutral (29.4%) attitudes toward marbling. As compared to retailers with greater retailer assistance, retailers at stores with greater self-service were more likely to report that customers had negative or neutral attitudes toward marbling, X2 (df = 2, n = 204) = 16.45, p < .001. Table 2 shows the distribution of frequencies across those categories.

Table 2. Percentage Frequency Response of Retailers that Provide >75% Assistance, 50% Assistance or <25% Assistance at the Meat Case to Consumer Perception of Marbling.

|

|

Level of Retailer Assistance Provided |

||

|

Perception of Marbling |

>75% Retailer Assistance |

50% Retailer Assistance |

<25% Retailer Assistance |

|

Negative and Would Select Against |

3.9% |

7.8% |

58.8% |

|

Do Not Select For or Against Marbling |

6.9% |

4.9% |

17.6% |

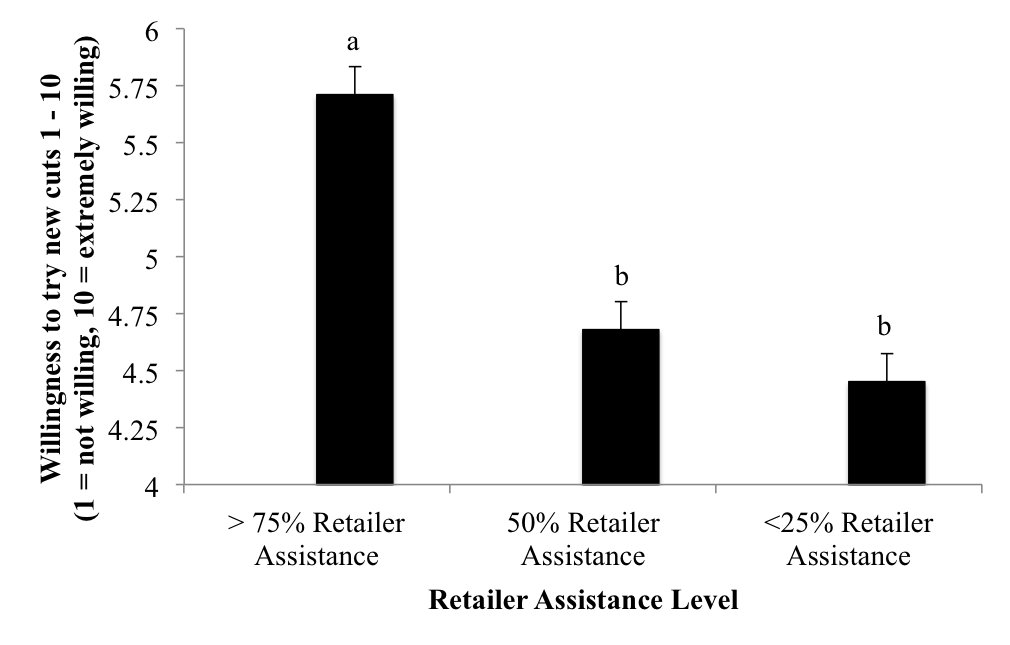

In addition, there was a significant difference in the perceived willingness to choose different cuts of beef based on retail case assistance (Figure 1), such that with high levels of retailer assistance (75% or more), consumers were more likely to choose new or different cuts than when lower levels of retailer assistance were provided (50% or less), F (2, 205) = 5.21, p < .05.

Figure 1. Relationship Between the Response for the Perception for Consumers’ Willingness To Try New Cuts and the Level Of Assistance Available Within a Retail Setting.

Consumer Purchasing Habits

Consumer’s Beef Purchasing Priorities

Respondents were asked to rank price, value, freshness, health concerns, fat content and color with respect to consumer selection priorities for beef products. Color was included in this ranking because product appearance is an important selection trait evaluated by consumers. However, color can also be misinterpreted depending on the maturity of the animal, pre-harvest stress and the type of packaging. Price and value were consistently perceived as the first and second priorities respectively for consumers when selecting meat. Fifty one percent (n =106) of respondents ranked price as the highest priority for consumers when they make selections, and 35.6 % (n =74) of respondents ranked value as the second most important priority for consumers. While the ranking was mixed for the other traits evaluated, price and value were never perceived as being the least valuable of the priorities evaluated.

Changes in Consumer Purchasing Habits

When asked about changes in beef purchasing over the past year only 1.9 % (n = 4) of respondents indicated a perceived increase in beef purchases while 23.1 % (n = 48) indicated a perceived decrease in beef purchases over the past year. The greatest number of respondents, 51% (n = 106), indicated that they believed consumers were substituting other, less expensive, protein sources in place of beef. Yet, 22.1 % (n = 46) indicated that they perceived there has been no change in beef purchases. Another factor affecting changes in beef purchasing behavior is exposure to negative beef-related news. When negative news related to beef breaks, 47.1 % (n =98) of respondents indicated that they perceived it required one month for consumers to return to normal purchasing habits.

Consumer Beef Knowledge

Source of Beef Purchasing Knowledge

Respondents were asked where they perceived consumers obtained the largest portion of their beef purchasing information. As indicated by Table 3, retailers indicated that they perceive consumers primarily receive their information from others in their home (handed down).

Table 3. Ranking of Retailer Perception of Consumer Sources of Beef Purchasing Information

|

Source |

Rank |

|

Handed down information learned in the home |

1 |

|

Friends and Social Groups |

2 |

|

In-store information |

3 |

|

Cooking Shows |

4 |

|

Internet |

5 |

|

News Media |

6 |

In addition to ranking perceptions of where information was obtained, a strong negative correlation r (206) = -.203, p = <.01 was observed for the perceived influence that news media has on consumers’ beef purchasing decisions, such that as news media influence increased, consumers were less likely to believe in store information.

The Effect of Additional Information on Beef Sales

If additional information was available to the consumer at the point of sale, 59.6 % (n = 124) of respondents indicated that they believed it would produce a slight increase in consumer comfort with beef purchases and increased beef sales. The remaining respondents (n = 84; 40.4%) believed it would produce extreme increase in comfort and beef sales. Further, respondents never perceived that additional information would decrease or extremely decrease consumers’ comfort with beef purchases or beef sales when available at the point of sale. Across all selection preferences, retailers felt that providing information to consumers at the point of sale would have a positive effect on consumer comfort and beef sales.

Conclusion and Implications

Research supports that not all proteins are created equal, and that animal proteins are considered a source of ‘high quality protein’ based on the amount and proportion of the amino acids they contain (Pasiakos et al., 2015). More specifically, beef provides a good or excellent source of 10 essential nutrients and there are over 30 cuts of beef that qualify as “lean” according to the FDA Food Labeling Guide (less than 10 g total fat, less than 4.5g saturated fat, and less than 95 mg cholesterol per 3.5 oz serving; FDA, 2013). However as consumers become more removed from Agriculture they question production practices, health benefits and safety of products such as beef. Many of these consumers rely on retail establishments to provide information about beef. Therefore this study aimed to understand the consumer from the perspective of the retailer.

Collectively, the results highlighted the challenge of limited customer service at the retail case and reinforced that customers are more confident in selecting new cuts when retail assistance is provided. Further evaluation of retailers indicated that price and value are the first and second priorities for consumers when purchasing beef. Surveys also revealed that information gained in the retail store was cited as the third most prevalent source of information behind in-home and friends/social groups. Recognizing the challenges consumers face at the retail level when making food purchases is the first step toward education. Extension personnel can partner in this effort by providing training, education and resources to retailers, so they can more effectively communicate with customers at the meat case. Such efforts will also improve the transparency of the agricultural industry, however future research into the best methods for disseminating information at the retail level is warranted.

Acknowledgement

This project was funded in part by a grant from the South Dakota Beef Industry Council. Salaries and research support provided by state and federal funds were appropriated to South Dakota State University.

Literature Cited

Bailey, D., Bastian, C., Menkhaus, D. J., & Glover, T. F. (1995). The role of Cooperative Extension in the changing meat industry. Journal of Extension [On-line], 33(4) Article 4FEA2. Retrieved from: http://www.joe.org/joe/1995august/a2php

Cattlemen’s Beef Board and National Cattlemen’s Beef Association. (2009). Limiters of Beef Consumption. Retrieved from: http://www.beefresearch.org/CMDocs/BeefResearch/limiters%20of%20beef%20consumption.pdf

FDA Office of Nutrition, Labeling and Dietary Supplements. (2013). Food Labeling Guide. Retrieved from: http://www.fda.gov/Food/GuidanceRegulation/GuidanceDocumentsRegulatoryInformation/LabelingNutrition/ucm064916.htm

Menzie, E. L., Gordin, Z. & Archer, T. F. (1976). Consumer attitudes, knowledge and buying habits relative to beef. University of Arizona Ag Experiment Station, Bulliten #226.

National Cattlemen’s Beef Association, National Pork Board, and Sealed Air Corporation. (2010). A snapshot of today’s retail meat case: 2010 National Meat Case Study Executive Summary. Natl. Cattlemen’s Beef Assoc., Centennial, CO.

Pasiakos, S. M., S. Agarwal, H. R. Lieberman, & V. L. Fulgoin III. (2015). Sources and amounts of animal, dairy and plant protein intake of US adults in 2007-2010. Nutrients, 7, 7058-7069. doi: 10.3390/nu7085322

Van Wezemael, L., Ueland, O., Rodbotten, R., De Smet, S., Scholderer, J., & Verbeke, W. (2012). The effect of technology information on consumer expectations and liking of beef. Meat Science, 90, 444-450. doi: 10.1016/j.meatsci.2011.09.005

Yang, S. H. & T. Woods. (2016). Consumer meat purchasing survey: Observations of millennial and urban/rural residence trends in meat purchasing in Kentucky, Tennessee, Ohio, Illinois and Indiana. University of Kentucky Agricultural Economics Extension Publication 2016-12.