Journal of the NACAA

ISSN 2158-9429

Volume 12, Issue 1 - June, 2019

Farmers Market Consumers’ Perceptions of Heritage Breed Chickens

- Dasgupta, S., Professor and Principal Investigator, Kentucky State University

Bryant, R.C., Extension Associate, Kentucky State University

Wright, A, Small Farm Agent, Kentucky State University

Pescatore, A., Professor and Extension Poultry Specialist, University of Kentucky

Jacob, J., Poultry Extension Project Manager, University of Kentucky

ABSTRACT

Heritage breeds of chickens are standard breeds of chickens that are hatched through natural reproduction. These chickens represent a product that might muster a significant demand in direct-to-consumer markets. This paper reports the results of a study of the perceptions of Kentucky’s farmers market patrons towards heritage breeds of chickens. The results showed that the consumers were willing to buy such products; however, with respect to characteristics such as flavor and texture, they did not differentiate the heritage breeds over standard broilers. Their willingness to pay for heritage breeds was on par with processed broiler prices at farmers markets.

Introduction

In order to be profitable, small-scale farms often produce unique products that differentiate their products from more mainstream products. Examples of this abound in produce farming where many small-scale farms diversify away from conventionally-grown vegetables and focus on certified organic vegetables or heirloom vegetables. Small-scale poultry farms could also benefit from having alternatives to Cornish Cross or Cornish hybrids that are produced by large, vertically-integrated poultry agribusinesses. Heritage breeds of chicken (HBC) could be one such alternative product.

According to The Livestock Conservancy, HBC are defined to be chickens that are from parent and grandparent stock of breeds recognized by the American Poultry Association prior to the mid-20th century, produced by natural mating, have long, productive outdoor lifespans and have a slow growth rate (The Livestock Conservancy, 2016). Because HBC are slower growing than the standard meat-breeds (i.e., Cornish Cross or Cobb hybrids) they have higher costs of production. It is conjectured that HBC tastes better than the standard breeds of chickens; this could generate consumer demand for HBC that might translate into a willingness to pay premium prices, justifying their production at a small scale.

Raab et al. (2017) reported the willingness to buy live HBC among Hispanic consumers in Kentucky. They discovered that Hispanic consumers preferred live Black Australorps over other HBC such as Barred Rock, Buff Orpington, Rhode Island Red, and Wyandotte. Their stated willingness to pay for live HBC was, on average, $8.84 per rooster and $9.04 per hen. This paper extends the findings of Raab et al. (2017) by conducting a pilot study to investigate the perceptions of consumers at farmers markets toward processed HBC.

Lusk (2018) reported on consumer beliefs about slow-growing chickens versus fast-growing broilers. They used chicken breasts from both types of chickens as their example products and presented consumers with a choice to pay or not pay premium prices for slow-growing chickens. Their results showed that, in general, consumers had low knowledge about broiler production and slow-growing chickens. The willingness to pay for slow-growing chickens was dependent upon the amount of information provided to the consumers participating in the study. Consumers were price sensitive and the majority of consumers were unwilling to pay premium prices for slow-growing chickens.

Farmers markets are an integral part of the small-scale agriculture scene in Kentucky. According to the Kentucky Department of Agriculture, the state has over 160 farmers markets in its 120 counties (KDA, 2018). Locally-grown meat sales are becoming increasingly popular at farmers markets. According to the Kentucky Center for Agriculture and Rural Development (KCARD, 2018), locally-sourced and processed meats are some of the “Top 100 hot foods” in farmers markets. They also reported that farmers market consumers prefer locally-grown meats because they can get unique cuts of meat or “naturally grown” meats (e.g., meats that are free of supplemental hormones), which are less available at grocery stores. It should be noted, however, that hormones are not used in commercial poultry production. Since HBC are more “natural” than standard broilers because they grow at a slower pace and they can reproduce naturally, there is potential for HBC to garner interest among farmers market consumers. The goal of this paper is to verify this hypothesis.

MATERIALS AND METHODS

During 2015, HBC such as Black Australorp, Barred Plymouth Rock, and Rhode Island Reds, as well as Cornish Cross broilers, grown by the University of Kentucky poultry farm, were processed at USDA-certified facility and brought to four farmers markets in order to elicit the consumer perceptions of HBC. Whether a farmers market allows the sale of meat depends upon the decisions made by their board of directors. At the current time, only a few farmers markets allow meat sales. Given that this was a pilot study, farmers markets that already featured meat products were chosen for this study. It was assumed that the patrons of these markets would be more open towards purchasing locally-grown poultry than patrons of farmers markets where meat sales are absent.

Three types of processed chickens were brought to the farmers markets: HBC grown on pasture (aka Product A), HBC grown indoors (aka Product B), and standard broilers grown indoors (aka Product C). The chickens were roasted with a minimum of spices at each farmers market and the cooked meat was placed in several small plastic cups that were suitable for individual sampling. Three trays of chicken were labeled “Product A”, “Product B”, and “Product C” and displayed prominently. Farmers market patrons were invited to taste each product and respond to a few survey questions (Table 1). Before sampling the food, they were informed about HBC and how they differ from standard broilers that are sold in many retail outlets. They were also shown color photographs of male and female HBC of five breeds including Wyandottes and Buff Orpingtons in addition to the three listed above and Cornish Cross broilers. They were also told that the meat samples were from HBC grown on pasture and indoors, and standard broilers; however, they did not know what types of chickens constituted Products A, B, and C. The data provided by the respondents were analyzed to identify trends and perceptions towards HBC.

Table 1. Survey questions.

|

Question |

Possible responses |

|

How often do you shop at a farmers’ market? |

Multiple choices |

|

Are you the primary food shopper in your household? |

Yes, No |

|

Have you eaten heritage breeds of chickens (HBC) before? |

Yes, No, I don’t know |

|

If YES, where did you eat HBC? |

Open ended question |

|

What cuts of chicken are you most likely to buy? |

Open ended question |

|

If only whole processed chickens were available, will you buy them? |

Yes, No, I don’t know |

|

How important is it for you to buy locally-grown meats? |

Very/somewhat/not important; or I don’t know |

|

How important is it for you to buy organic foods? |

Very/somewhat/not important; or I don’t know |

|

How important is it for you to buy chickens grown on pasture instead of inside buildings? |

Very/somewhat/not important; or I don’t know |

|

How important is it for HBC to be sold at farmers’ markets? |

Very/somewhat/not important; or I don’t know |

|

Of the three products, which one had the most distinct flavor |

Products A, B , or C or I don’t know |

|

Of the three products, name one that you liked the most |

Products A, B , or C |

|

Of the three products, name one that you liked the least |

Products A, B , or C |

|

Rate the flavor, texture, and overall features of Products A, B, and C |

On a 0 to 10 scale; 0: extreme dislike and 10: extreme like |

|

What is the maximum price ($/whole processed chicken) that you are willing to pay for HBC grown indoors? |

Open ended |

|

What is the maximum price ($/whole processed chicken) that you are willing to pay for HBC grown on pasture? |

Open ended |

|

Gender, race, age, education, household size, etc. |

Multiple choices |

RESULTS

While many farmers market shoppers participated in the tasting of Products A, B, and C, only 51 individuals completed the survey questionnaires. Table 2 reports the demographic characteristics of the respondents. While there was almost an equal number of men and women who responded to the survey, the majority of respondents were Caucasian. This lack of diversity is typical of Kentucky’s farmers market clientele. Dasgupta et al. (2010) reported a similar result in an earlier study related to Kentucky’s farmers markets. Table 2 shows that most of the respondents were educated in that 78 percent had either a 4-year college degree or an advanced degree and most were employed in jobs that required advanced training. Their household sizes were relatively small, with the most-reported size being two people. Approximately two-thirds of the respondents stated that they were the primary food shopper in their household. Additionally, these respondents were frequent shoppers at farmers markets, with 50 percent reporting that they shopped at the farmers market every week and over 80 percent indicating that they visited farmers’ markets at least once a month.

Table 2. Respondent characteristics and summary of perceptions towards heritage breeds of chickens (HBC). N = 51.

|

Characteristics |

Results |

|

Gender |

52% male |

|

Race |

90% Caucasian, 5% Asian, 5% Hispanic |

|

Age |

34% were <= 40 |

|

Education |

22% had less than a 4-year college degree |

|

Household size |

Mean = 2.67; Std. dev. = 1.27; Mode =2 |

|

Primary grocery shoppers for their household |

66% |

|

How often did they shop at a farmers’ market |

Weekly (50%), Twice monthly (15%); Once per month (10%); Less often than once per month (6%); Rarely (19%) |

|

Occupation of the main wage earner of the household |

51% had professional jobs requiring |

The survey elicited responses about the perceptions of farmers market patrons towards locally-grown meats and organic foods. Additionally, they were asked about their preference for chickens grown on pasture versus those grown indoors, which is common practice for large-scale broiler production. The results are summarized in Table 3, which shows that more than half of the respondents considered locally grown foods, organic foods, and pasture-raised poultry to be “Very Important”.

Table 3. Respondent perceptions towards local foods and poultry production methods. N=51.

|

Characteristics |

Results |

|

Importance of buying locally-grown meats |

Very important (63%) Somewhat important (35%) Not important (2%) |

|

Importance of buying organic foods |

Very important (55%) Somewhat important (23%) Not important (19%) |

|

Importance of having chickens grown on pasture |

Very important (62%) Somewhat important (30%) Not important (8%) |

The survey respondents also stated their past experiences in consuming HBC. Table 4 reports that only 28 percent of respondents had tasted HBC in the past. When asked about the circumstances of their tasting HBC, all replied that they had eaten the chickens as a child or as a young adult on a family member’s farm. Table 4 also reports on the importance that the farmers market patrons placed on having HBC available for sale at farmers markets: the results show that only 21 percent of the survey respondents considered it ‘Very Important” to have HBC. However, there was no correspondence between the above two results, i.e., only three individuals who reported eating HBC earlier in life indicated that having HBC at farmers markets to be “Very Important”.

Table 4. Experience and perceptions of respondents towards heritage breeds of chickens (HBC). N = 51.

|

Characteristics |

Results |

|

Respondents that have tasted HBC before this study |

28% |

|

The importance that respondents assign to having HBC at farmers’ markets |

Very important (21%) Somewhat important (40%) Not important (15%) |

|

The chicken product that had the most distinct flavor |

Product A: HBC raised on pasture (34%) Product B: HBC raised indoors (38%) Product C: Standard broilers (28%) |

|

The most preferred chicken product |

Product A: HBC raised on pasture (28%) Product B: HBC raised indoors (40%) Product C: Standard broilers (32%) |

|

The least preferred chicken product |

Product A: HBC raised on pasture (37%) Product B: HBC raised indoors (28%) Product C: Standard broilers (30%) |

After tasting the three types of chickens, the respondents were asked to pick one of the three products that had the most distinct flavor; Table 4 reports the distribution of the percentage of respondents choosing among the three products. A chi-squared test revealed that there were no significant differences among the three percentages (P= 69.62%). Also, questions were asked about which product the respondents liked and disliked the most. Table 4 indicates the distributions of the results, which might give the impression that Products B and A were the most and least favorite, respectively; however, chi-squared tests compared the corresponding proportions and revealed that there were no significant differences among the reported preferences (P = 40.92% for most preferred product and P =64.81% for least preferred product). Respondents also stated which cuts of chickens they preferred: 38% preferred fresh breast quarters, 33% preferred fresh whole chickens, and 12 % preferred fresh leg quarters. Frozen chickens were very unpopular. If only whole processed chickens were available at farmers markets, 85% of the respondents indicated that they would purchase such a product.

The respondents rated the flavor, texture, and overall characteristics of Products A, B, and C on a 1 to 10 scale, where 0 indicated “extreme dislike” and 10 indicated “extreme like”. With respect to flavor, the average ratings (± standard deviation) were 7.08 (± 2.28) for HBC raised on pasture (Product A), 6.79 (± 1.83) for HBC raised indoors (Product B), and 7.41 (± 1.93) for standard broilers (Product C). The Mann-Whitney test revealed that the flavor ratings for Products A and B and Products A and C were not significantly different. However, the ratings for Products B and C were significantly different at P = 8% level of significance. Similar analyses with respect to consumers’ perceptions of texture revealed average ratings of 7.16 (± 2.39), 7.14 (± 1.81), 7.42 (± 1.87) for Products A, B, and C, respectively, with no significant statistical differences. Correspondingly, the average consumer ratings for overall characteristics were 6.25 (± 2.47), 7.18 (± 1.76), 7.53 (± 2.39) for Products A, B, and C, respectively, with no significant statistical differences.

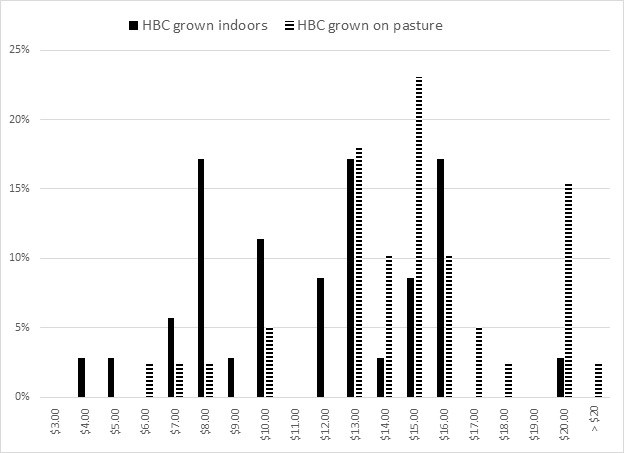

The survey also elicited information about the respondents’ stated willingness to pay for HBC. Figure 1 shows the distribution of respondents' stated willingness to pay for whole-processed HBC. The average stated willingness to pay was $11.67 and $14.96 for HBC raised indoors and on pasture, respectively. Statistically, these average prices were significantly different from one another because the P-value of the test was 0.4% which was less than the Type I error probability which is typically 1%, 5%, or 10%. Thus, respondents were willing to pay higher prices, on average, for HBC grown on pasture.

Figure 1. Stated willingness to pay for a whole heritage breeds of chickens (HBC) grown indoors versus grown on pasture.

While processed chickens are sold at Kentucky’s farmers markets, there is no established database of current and historical prices. Despite this deficiency, current retail prices of processed chickens were obtained from a website featuring local foods and farms that sell at farmers markets (www.localharvest.org; Table 5). Assuming whole processed chickens range from 3 pounds to 5 pounds, Table 5 shows that farmers market patrons currently pay from $12 to over $20 per whole processed chickens, or $11.25 to $18.74 in 2015 U. S. dollars (Bureau of Labor Statistics 2018). Figure 1 shows that 57% and 87% of survey respondents were willing to pay from $11.25 to $18.74 for whole processed HBC grown indoors and on pasture, respectively. Therefore, Figure 1 shows that the majority of the surveyed consumers stated that they were willing to pay prices for HBC that were within the range of prices charged by farms that sell processed chickens at Kentucky’s farmers markets.

Table 5. Retail prices of processed chickens sold in Kentucky’s farmers’ markets.

|

Price |

Product |

Source |

|

$18.50 |

For 3-pound processed chickens |

Elmwood Stock Farm |

|

$20.00 |

Processed, whole pastured chickens |

Hickory Grove Farm |

|

$25.00 |

Processed, whole, certified organic chickens |

Rankin Farm |

|

$5.50 |

Per-pound price for whole organic pastured broilers |

Freedom Run Farm |

|

$4.75 |

Per-pound price for processed whole pastured broilers |

Riverside Farm |

|

$4.00 |

Per-pound price for processed whole pastured broilers |

Good Life Ranch |

|

$19.72 |

Processed, whole chickens |

Sevens Sons |

|

$5.00 |

Per-pound price for processed whole pastured broilers |

Pike Valley Farm Foods |

|

$4.25 |

Per-pound price for processed whole pastured broilers |

Lone Oak Pastures |

|

$4.75 |

Per-pound price for processed whole pastured broilers |

Six Ridges Farm |

CONCLUSIONS

This paper is a pilot study of consumers’ perceptions of processed heritage breeds of chickens (HBC) in Kentucky’s farmers markets. The farmers market patrons who participated in this study were instructed about HBC and how they differ from standard broilers. They tasted samples of HBC grown on pasture and grown indoors; they also tasted some standard broilers that typically sold in many retail food outlets. Their perceptions show that, on average, they considered HBC to not be particularly unique as a food product when compared to the standard broilers. This conclusion is supported by Table 4, which shows that consumers did not ascribe significant uniqueness to cooked HBC over cooked standard broilers. Additionally, the ratings that this study’s participants gave with respect to the flavor, texture, and overall characteristics of the chickens were not significantly different from one another. The only exception, albeit at 8% level of statistical significance, showed that the flavor ratings of standard broilers were higher than the corresponding ratings for HBC grown indoors.

The average stated willingness to pay, in 2015 U. S. dollars, for processed whole HBC was $11.67 and $14.96 for chickens raised indoors and on pasture, respectively. In 2018 U. S. dollars, these prices correspond $12.45 and $15.95, respectively. Table 5 shows that this willingness to pay values is on par with prices of whole processed broilers in Kentucky’s farmers’ markets. Although the respondents showed a preference for HBC grown on pasture, they were unwilling to pay premium prices for the product. Since HBC are slower-growing animals than the Cornish or Cobb hybrid broilers, they are most likely to be more expensive to culture. Therefore, the results of this paper suggest that poultry farmers would be better-off producing standard broilers over HBC for sales at farmers’ markets.

LITERATURE CITED

Bureau of Labor Statistics. (2018). Archived consumer price index supplemental files. Available at: https://www.bls.gov/cpi/tables/supplemental-files/home.htm.

Dasgupta, S., S. Wesley, and Probst, K.R. (2010). Hispanic consumer perception of Kentucky-grown pigs. Journal of the Kentucky Academy of Science 71:54-58.

Kentucky Center for Agriculture and Rural Development (KCARD). (2018). Farmers markets: Trends, issues, and resources. Available at: http://www.kcard.info/node/468.

Kentucky Department of Agriculture. (2018). Farmers' Market. Available at.: http://www.kyagr.com/marketing/farmers-market.html.

Livestock Conservancy. (2016). Available at: http://livestockconservancy.org/.

Lusk, J. (2018). Consumer preferences for and beliefs about slow growth chicken. Poultry Science 97: 4159-4166.

Raab, D, S. Dasgupta, J. Kelso, A. D. Wright, R. C. Bryant, A. Pescatore, and Jacob, J. (2017). Selling live heritage breed poultry to Hispanics. Journal of the NACAA 10(1). Available at: https://www.nacaa.com/journal/index.php?jid=695.

ACKNOWLEDGEMENTS

Funding for this study was provided by USDA-NIFA-AFRI Award No. 2012-68006-30201. This research has been a cooperative effort between the University of Kentucky and Kentucky State University.